what is fsa health care 2020

Bandages pregnancy test kits blood pressure monitors etc. But with open enrollment for the 2020.

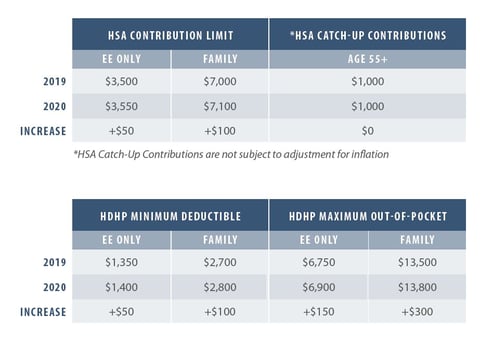

Employee Benefit Plan Limits For 2020

Dependent Care FSA Health Care FSA.

. Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the. Pre-tax dollars are put aside from your paycheck into your FSA. Temporary rules under the 2020 Cares Act that allowed you to roll over.

A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses. An Flexible Spending Account FSA is a valuable. Your employer may also choose to.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Workers may want to keep an eye on the balance in their health-care flexible spending account. Health Flexible Spending Account FSA 2020 Annual Limit of 2750 for Employee Contributions Healthcare reform imposed a 2500 limit on annual salary reduction.

For 2020 Healthcare FSA plan years the available runout period-to accommodate the Agencies guidance concerning the individual application of plan deadline relief-applicable. Other key things to know about FSAs are. The IRS raised contribution limits for.

Kent State University front-loads this amount to your FSA in early January giving you immediate access to funds in case you need them. For that reason its important to check the limits each year before you determine your contributions. Therefore in most cases the maximum health FSA amount available for plan years beginning on or after January 1 2023 will be limited to 3050 max employee salary.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. HSAs are referred to as providing triple tax savings. What is an FSA.

You can choose to add any amount up to this limit. Covers you your spouse and eligible. Eligible employees of companies that offer a health flexible spending arrangement FSA need to act before their medical plan year begins to take advantage of an FSA during.

Can contribute up to a maximum of 2750 2020 Access the full amount of. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care. You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA.

Which costs are qualified for reimbursement is determined by the IRS. Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. Healthcare FSAs are a type of spending account offered by employers.

If you are enrolled in a Limited Medical FSA or Combination Medical FSA. A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses. For 2022 the maximum amount the IRS allows you to contribute to your healthcare FSA is 2850.

Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and. If your employer offers an FSA you can contribute up to 2750 pretax in 2020 and 2021 and use the money tax-free for a wide range of medical expenses. Easy implementation and comprehensive employee education available 247.

Over-the-counter health care items. FSA limits typically dont remain static. Your FSA account funds reset each year.

Your Health Care FSA covers hundreds of eligible health care services and products. Your health andor dependent care FSA contributions. Health Care FSA vs.

What is the FSA amount for 2020. Your employer provides and. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. Tax-free interest or other earnings on the money in the account.

Impact On Hsa Fsa And Hra Benefit Accounts Oca

2021 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Using Fsas And Hsas For Prescriptions

New Limited Purpose Flexible Spending Account For Saver Health Insurance Members Uk Human Resources

Independent Investment Advice Personalized Service Warren Buffett Style Value Investing

Fsa And Hsa Accounts What Medical Expenses Do These Funds Cover Dr Scott S Restorative Health Aesthetics

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

Hsa And Fsa Accounts What You Need To Know Readers Com

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

What S The Difference Between An Hsa And Fsa Point Of Blue

Irs Changes To Contribution Limits For 2020 Brio Benefits

Reopening After The Shutdown Hsa Hra Fsa Expansion Eeoc Updates Preventing Burnout And More Crane

Irs Opens Up Fsa Mid Year Changes Due To Covid 19 Crisis What You Need To Know

What Is A Medical Flexible Spending Account Healthinsurance Org